Your future self will thank you

Savvy replaces financial anxiety with the confidence that comes from having a realistic plan.

No credit card · Set up in minutes · Bank sync coming soon at $8/mo

Most budgeting apps tell you what already happened

- Backward-looking dashboardsPretty charts of last month’s spending don’t help you decide what to do this week.

- Auto-categorization guessworkWhen an app decides “Costco” is entertainment, you stop trusting the numbers.

- Set-and-forget automationConvenience sounds great until you realize you haven’t looked at your budget in three months.

A budget that looks forward, not back

- Weekly rhythm, not monthlyMonthly is too long to stay engaged. Savvy matches the real cadence of life, week by week, paycheck by paycheck.

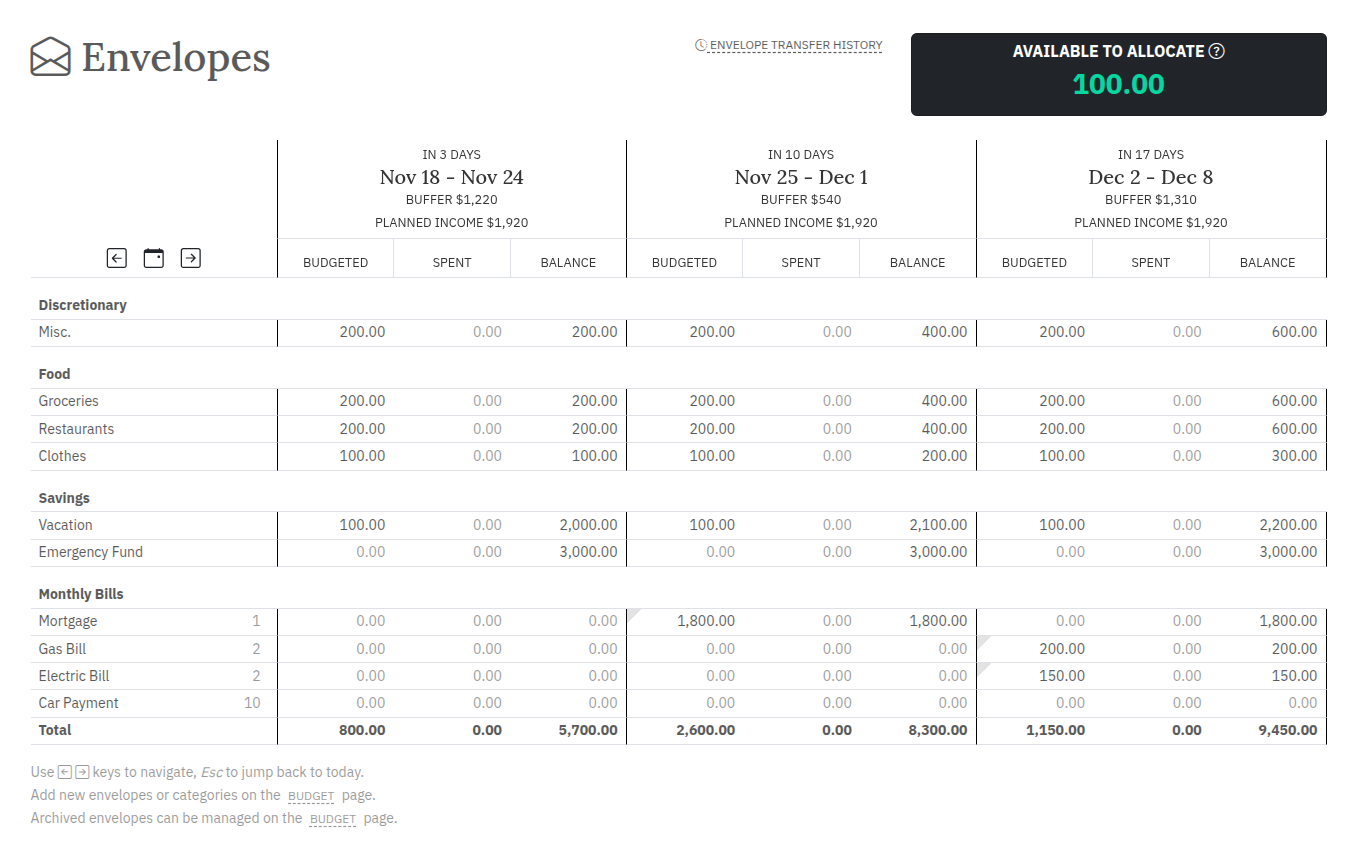

- Future-focused envelopesEvery envelope shows this week’s balance and what it will look like in the weeks ahead. Spot a shortfall in March while it’s still February.

- Earmark money for what mattersChristmas, car repairs, vacation, save a little each week and the big expenses stop being emergencies. After a while, there’s an envelope for everything.

- Flexible when life happensOverspent on groceries? Move money from clothing in seconds. The system bends with you instead of breaking.

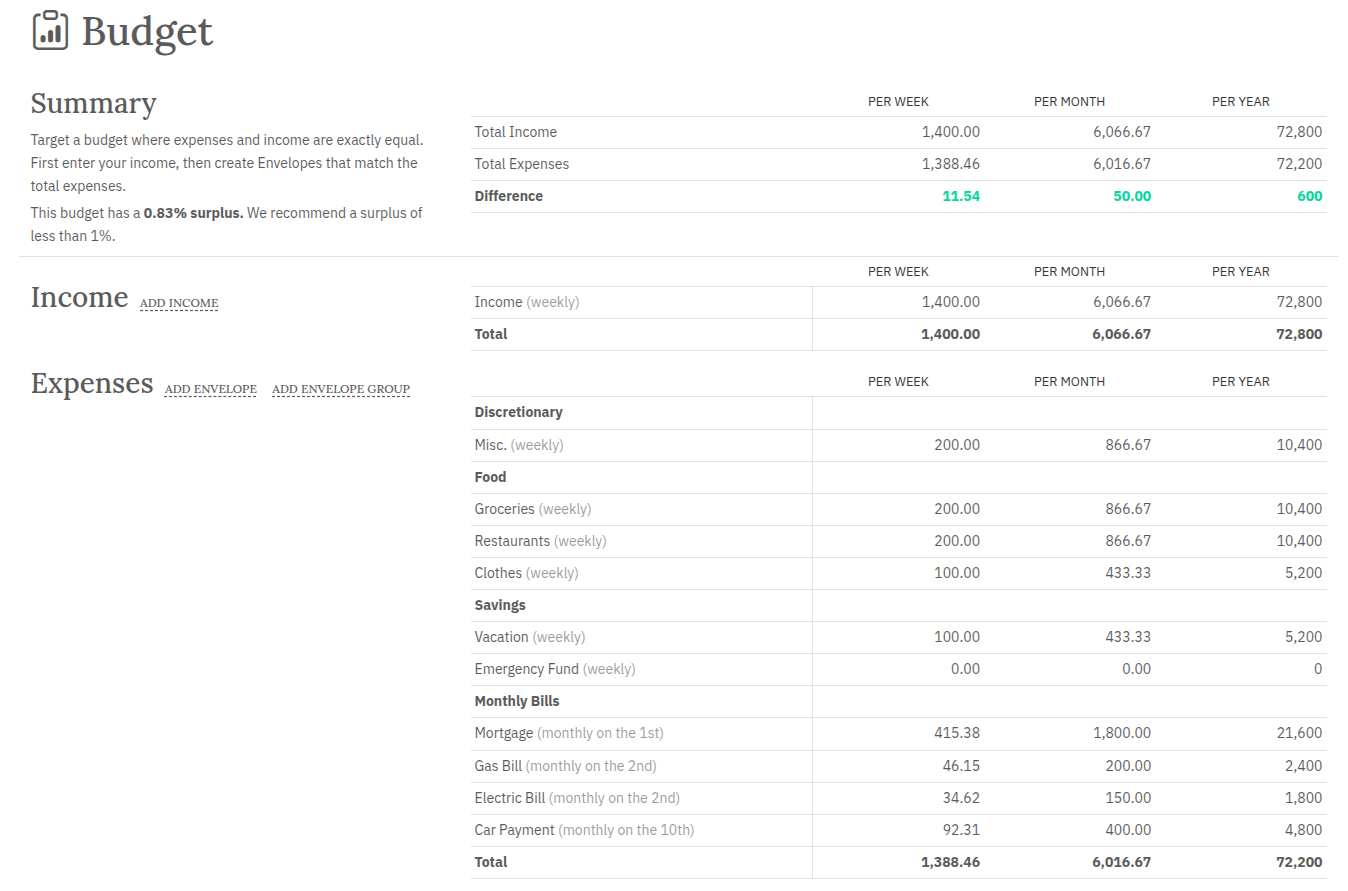

Income in, envelopes out, always balanced

Your budget is a living document. Income on one side, envelopes on the other. If they don’t balance, you’ll know exactly where the gap is, and fixing it takes seconds, not a spreadsheet.

Intentionally hands-on

We don’t connect to your bank. We don’t auto-categorize. That’s not a limitation, it’s the whole philosophy.

Manual entry builds awareness

Typing in each transaction forces a moment of reflection. That’s where real behavior change starts. Automation is comfortable; awareness is powerful.

Your data stays yours

No bank credentials, no third-party aggregators. Your financial data never passes through anyone else’s servers.

Weekly rhythm, lasting habits

Consistent weekly check-ins build the muscle memory of financial awareness. After a few weeks, it becomes second nature.

The point of a budget isn’t restriction, it’s permission. When you know what’s covered, spending feels good instead of guilty.

The Savvy approach to money

Spend an hour.

Gain a week of clarity.

One hour of focused budgeting gives you a full week of knowing exactly where you stand. Start with a free account and see how it feels.

Create Free Account